Anti-money laundering policy

Commentary on the importance of law firms having an anti-money laundering policy has been added to the By Lawyers Practice Management guide. This new section of commentary assists firms to deal with the risk of money laundering and suggests procedures that can be adopted to reduce those risks.

This new commentary contains links to the Anti-Money Laundering Guide for Legal Practitioners published by the Law Council of Australia. There are also links to helpful guidance materials published by the various state Law Societies.

By Lawyers Practice Management guide

The Practice Management guide provides assistance for all firms, whether start-up, breakaway, or well established. It covers the following main areas:

- How to perform a Legal Practice Health Diagnostic Check – a very useful tool for identifying existing strengths and areas where the firm can improve, or as a check-list for start ups.

- Business planning for a law firm – including a SWOT analysis and environmental scan.

- Ethics and professional responsibility – crucial to establishing and maintaining reputation and managing risk.

- The solicitor/client relationship – how to value and manage client relationships.

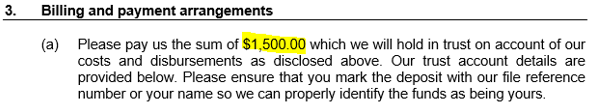

- The essentials of managing the work performed by law firms including, matter and data management, financial management and trust accounting.

The publication also contains many helpful precedents, such as:

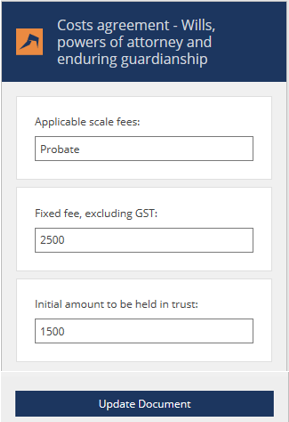

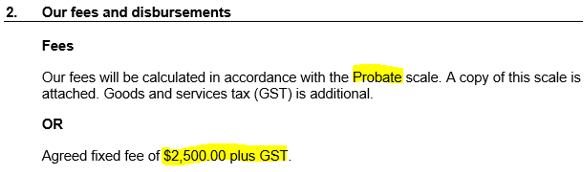

- Example costs disclosures.

- Example invoices.

- An example mission statement for a law firm.

- A risk management plan.

- Employment forms – including an application for employment and a new employee check-list.

- An example asset register.

- Forms for conducting file reviews.

- Document safe custody records.

- An example law firm client satisfaction survey.