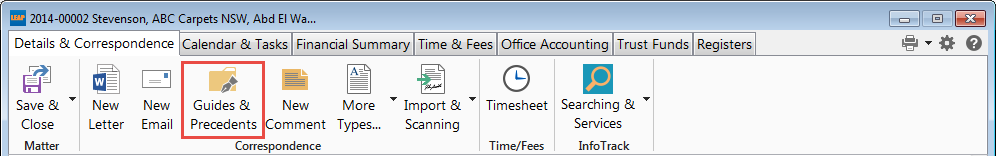

By Lawyers has launched a new set of precedents that can be used to establish an account based pension for members of a self-managed superannuation fund.

For more information check out the By Lawyers self-managed superannuation guide online or in LEAP.