Abbreviated costs disclosure is available to Queensland law firms from 1 March 2024.

A new section 307B of the Legal Profession Act 2007 (QLD) provides for a simpler form of disclosure where legal costs in a matter, excluding GST and disbursements, are not likely to exceed the detailed disclosure threshold set out in s 300, which is currently $3,000.

This new form of disclosure is available as an alternative to the detailed disclosure requirements under s 308 of the Act.

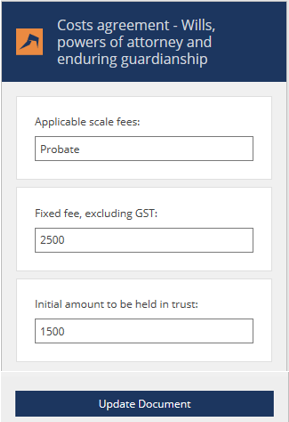

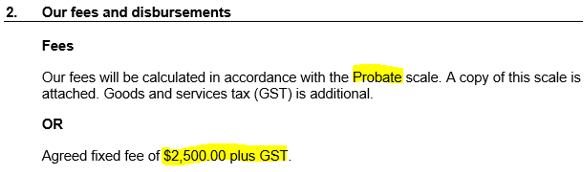

Under s 307B, a law practice is required to disclose to the client:

- in general terms, the legal services that will be provided to the client;

- the basis on which legal costs will be calculated, including whether a scale of costs applies;

- an estimate of the total amount of the legal costs;

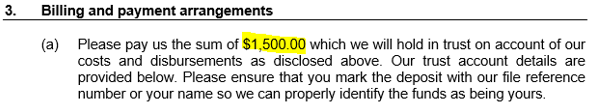

- an estimate of the total amount of disbursements; and

- the client’s right to:

- negotiate a costs agreement with the law practice;

- receive a bill from the law practice;

- request an itemised bill after receiving a lump sum bill; and

- be notified of any substantial change to the matters disclosed under s 307B.

All By Lawyers Queensland and Federal publications have been updated with a compliant abbreviated costs disclosure precedent.

By Lawyers 101 Costs Answers guide has been updated to include commentary on the new abbreviated costs disclosure requirements.