By Guy Dawson, CEO

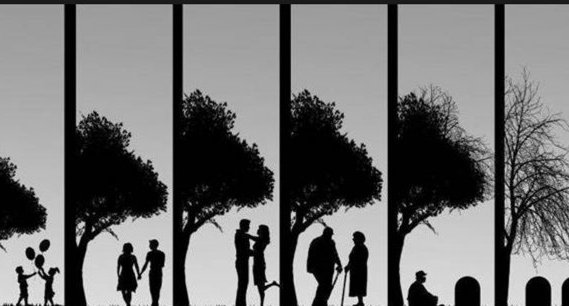

It is generally accepted that when two people get together there are circumstances that exist, or a period of time that has elapsed, before they can be considered life partners – before their financial lives are joined and divided in an equitable manner on separation or death.

In order to investigate whether there is in fact a de facto relationship in family, succession and superannuation law, the interpretation acts such as the Commonwealth Acts Interpretation Act 1901 section 2F sets out the matters to consider as follows:

(a) the persons are not legally married to each other; and

(b) the persons are not related by family; and

(c) having regard to all the circumstances of their relationship, they have a relationship as a couple living together on a genuine domestic basis. Working out if persons have a relationship as a couple the circumstances considered may include any or all of the following:

(a) the duration of the relationship;

(b) the nature and extent of their common residence;

(c) whether a sexual relationship exists;

(d) the degree of financial dependence or interdependence, and any arrangements for financial support, between them;

(e) the ownership, use and acquisition of their property;

(f) the degree of mutual commitment to a shared life;

(g) whether the relationship is or was registered under a prescribed law of a State or Territory as a prescribed kind of relationship;

(h) the care and support of children;

(i) the reputation and public aspects of the relationship.

Registering a relationship is tantamount to deciding to marry so it is not a common practice.

Family Law

For the Family Court to make orders, under the Family Law Act 1975, the time that must have elapsed for the finding of a de facto relationship is at least 2 years.

The other circumstances that may establish jurisdiction are:

- That there is a child of the de facto relationship; or

- That the party to the de facto relationship who applies for the order or declaration, made substantial contributions and a failure to make the order or declaration would result in serious injustice to the applicant; or

- That the relationship is or was registered under a prescribed law of a State or Territory.

Financial arrangements before the expiration of that time are matters for consideration by the courts as partnerships or joint venture arrangements.

Succession Law

Succession Law across the States defines the term partner or spouse to include a person who was either married to or in a domestic partnership with the intestate. Domestic partnership is a relationship for a continuous period of at least 2 years prior to death, or that was registered under a prescribed law of a State or Territory, or one that resulted in the birth of a child,.

Superannuation

The relationship test of 2 years, does not apply to the determinations of Superannuation Trustees under the Superannuation Industry (Supervision) Act 1993 .

The failure to include such a time period in the SIS legislation results in some ludicrous decisions which sees large sums of money paid to a boyfriend or girlfriend in a relationship of only a few weeks, or a month or two shacked up, without children and no registered relationship. Family members such as parents and siblings are often overlooked and receive nothing at all.

The SIS Act needs to be brought into line with family and succession law to provide the minimum period of 2 years so common sense can prevail.